Carbon Connect: Scaling Up Net Zero Investment

“Finance, both public and private, is critical to bridge this investment gap. We need to explore new financial models, improve messaging to homeowners and encourage cross-sectoral collaboration to break down barriers to investment and create a thriving green finance market” - Emma Harvey, Green Finance Institute

Carbon Connect met today to discuss the current state of play and progress in the delivery of net zero targets, to identify areas of focus for action and to draw lessons from other countries.

The meeting was chaired by Sarah Deasley of Frontier Economics who gave the introductory remarks and led the event.

The speakers at the event were

- Mike Thompson, Climate Change Committee

- Emma Harvey, Green Finance Institute

- Alan Whitehead MP

- Beata Bienkowska, LSE Grantham Research Institute Transition Pathway Initiative

- Dan Meredith, E.ON

- Tanguy de Bienassis, International Energy Agency

Participants were asked to reflect on some of the investments required to meet net zero targets by 2050, considering the respective roles for fiscal policy and private sector investment. How can the private sector be enabled to step up and create an investment climate that facilitates progress towards our climate targets, and where is input from government required?

Mike Thompson spoke on the levels of investment required in the power, transport and building sectors.

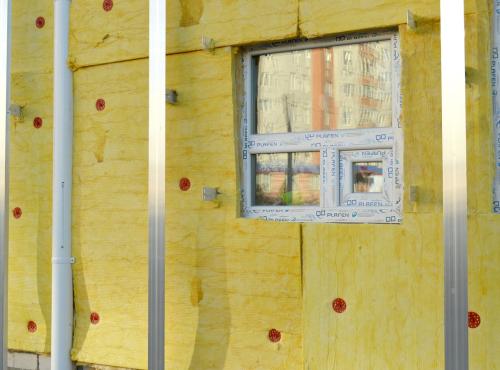

Dan Meredith spoke on energy efficiency: “tackling energy efficiency is not just about reducing emissions, it’s also about bringing down costs, improving quality of life and creating jobs. Insulate, insulate, insulate!”

Tanguy de Bienassis gives the international context and asked ‘what are the investments that are needed to achieve net zero in the energy sector?’ drawing on the IEA's net zero roadmaps.