Buildings Sector

CONTENTS

Progress Ranking and Key Recommendations | Sector Summary | Recent Policy Developments | Further detail: preliminary ranking | Further detail: CCC policy recommendations

Progress ranking and key recommendations

Progress Ranking: Insufficient (5/10) |

Key actions on the road to world-leading policy: |

|---|---|

|

The Government must act on the ambition set out in the Heat and Buildings Strategy and provide a pathway and public funding to reach longer term goals. This must contain the requisite ambition to put the sector on track to meet the UK's NDC, Sixth Carbon Budget and Net Zero target. For further details, see the underlying list of recommendations, but this should include:

Policy Connect has provided further recommendations for an ambitious Heat and Buildings Strategy via the ‘Pipeline to 2050: building the foundations for a harmonised heat strategy’ report.

|

Sector Summary

|

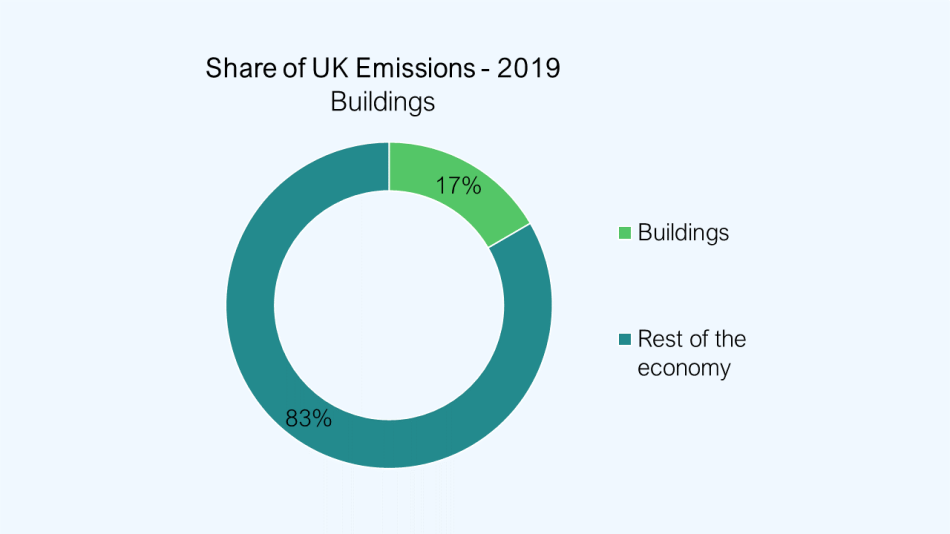

Source: Climate Change Committee - Sixth Carbon Budget (2020) |

Recent Policy Developments

- In October 2021, the Heat and Buildings Strategy was published, which sets out how the UK will decarbonise its homes, and commercial, industrial and public sector buildings. The Government stated that the market for heat pumps needs to grow to approximately to 600,000 installations per year by 2028.

- The Conservative Manifesto earmarked £9.2bn of funding for energy efficiency measures, via the Public Sector Decarbonisation Scheme, Social Housing Decarbonisation Fund and Home Upgrade Grants. Of this, £1bn of funding for public sector buildings has been allocated, as well as ~£600m via the Green Homes Grant (£500m directly to councils, and £100m via the application scheme for home-owners).

- The Green Homes Grant has now been scrapped, with the rest of the £1.5bn funding for the 2020-21 financial year taken back by the Treasury, and the £320m fund for 2021-22 allocated directly to councils. This leaves a funding gap for the able-to-pay market, as the remaining funding focuses on social housing and public sector buildings, and has damaged consumer and industry confidence.

- The Ten Point Plan committed the Government to:

- Implementing the Future Home Standard on new-build homes as soon as possible. This would require new-builds to have emissions 75-80% below current standards, and to be 'zero-carbon ready'. However, this is most likely to be introduced by 2025, rather than 2023 as had initially been suggested.

- Targeting 600,00 heat-pump installations by 2028

- Alongside this, the Energy White Paper brought the following commitments:

- Achieving EPC B by 2030 in all non-domestic rented buildings, where cost-effective.

- Continued action on fuel poverty, extending the Energy Company Obligation (which mandates larger energy suppliers to provide energy efficiency and heating measures for fuel poor customers) from 2022-26, and expanding the Warm Home Discount

- Increasing the proportion of biomethane in the gas grid, funded by the new Green Gas Levy announced in the Spring 2020 Budget

- Consulting on the role of 'hydrogen ready' appliances in late 2021

- Committing £122m towards a new Heat Network Transformation Programme, to support the rollout of district heating, with Local Authorities designating heat network zones by 2025 at the latest

Further detail: Policy recommendations from the CCC

|

# |

Focus |

Key Recommendation from the CCC |

Government Progress |

Met? |

|---|---|---|---|---|

|

1 |

Provide clear direction |

CCC argues that 'electrification is of primary strategy importance for Net Zero', even in areas where hydrogen grid conversion is widespread. 'It is essential that the Government sets a clear commitment to electrification through the 2020s, including a stable and long-term support framework to build heap pump supply chain to sufficient scale' |

The Government state clearly that the electrification of heating through the deployment of highly efficient electric heat pumps must form a major part of how we heat our buildings in all future scenarios. The Government note that to meet this the market for heat pumps needs to grow to approximately 600,000 installations per year by 2028. This level of heat pump deployment, including in new-build properties, is essential for ensuring an electrification-led route remains viable. The Government has launched a consultation on the introduction of a market-based mechanism to support investment and innovation in transforming the consumer proposition for heat pumps. The £60 million Net Zero Innovation Portfolio (NZIP) ‘Heat Pump Ready’ Programme will support the development of innovation across the heat pump sector, and aims at advancing heat electrification to support the decarbonisation of homes. |

Yes |

|

2 |

Provide clear direction |

Introduce phaseout dates and standards. This include |

- The HBS said they will ensure all new buildings in England are ready for Net Zero from 2025. They are bringing in the Future Homes Standard and have consulted on the Future Buildings Standard for new-builds in England. To enable this, the Government will introduce new standards through legislation (such as Building Regulations) to ensure new homes and buildings will be fitted with low-carbon heating and high levels of energy efficiency. - The HBS stated that all private-rented homes will meet EPC C by 2028 for all tenancies, and are aiming to publish a response to this consultation by the end of the year. - The Government closed a consultation on improving home energy performance through lenders on proposals to require mortgage lenders to disclose energy performance across their property portfolio and on introducing voluntary targets to improve the energy performance of their portfolios to an average of EPC band C by 2030. consultation proposes making these targets mandatory if insufficient progress is being made. - The HBS notes the Government will aim for as many existing homes as possible to achieve EPC C by 2035 - The HBS states that privately-rented commercial buildings will achieve a minimum efficiency standard of EPC band B by 2030 in England and Wales, and have consulted on how to enforce this target |

Yes |

|

3 |

Provide clear direction |

Introduce phaseout dates and standards. This include |

- The Government's Hydrogen Strategy states a consultation will be released later in 2021 on the case for enabling, or requiring, new natural gas boilers to be easily convertible to use hydrogen (‘hydrogen-ready’) by 2026. - The HBS states the Government will consult on ending the installation of high-carbon fossil fuels to heat homes that are not connected to the gas grid in England from 2026 and non-domestic buildings not connected to the gas grid from 2024 - The Government has set the ambition of phasing out the installation of new natural gas boilers from 2035 - The Government has further launched a call for evidence on decarbonisation pathways for CHP operators, which is open to 20 December 2021 |

Partly |

|

4 |

Making low-carbon buildings financially attractive |

Enable household-level flexibility by implementing Smart Systems and Flexibility Plan |

The CCC state that to develop a more flexible electricity system, the Government has published a Smart Systems and Flexibility Plan, a Digitalisation Strategy, and a call for evidence on large-scale long-duration storage. The Government is also considering reform of the status and role of the Electricity System Operator, with a view to it taking a stronger role in network planning and provision of advice across the wider energy system on how to drive forward Net Zero ambitions. The availability of smart tariffs will allow consumers to take advantage of the flexibility afforded by heat pumps and storage; potentially shifting demand and reducing fuel bills. |

Yes |

|

5 |

Making low-carbon buildings financially attractive |

Rebalance policy costs, where currently fuel duty on gas is too low, and fuel duty on electricity is too high. A favourable VAT regime is also needed for low-carbon technologies |

The Green Gas Levy will apply to gas prices and reduce this discrepancy. There is also a commitment in the HBS to look at rebalancing policy costs on electricity and gas to favour electrification. The Strategy commits to the launch of a Fairness and Affordability Call for Evidence to help rebalance electricity and gas prices and to support green choices, with a view to taking decisions in 2022. The CCC has said this must progress in the coming months. |

Partly |

| 6 |

Making low-carbon buildings financially attractive |

Introduce a favourable VAT regime for low-carbon technologies |

There is no mention of a favourable VAT regime for low-carbon technologies. As the Heat and Buildings Strategy expects a lot of these technologies and cost reductions to be market led, there is further scope for the Government to regulate VAT to drive costs down |

No |

|

7 |

Making low-carbon buildings financially attractive |

The Government must assess how the cost of all forms of heating can be made fair, and low-income/vulnerable households protected |

The Government is boosting funding for the Social Housing Decarbonisation Fund, investing a further £800 million over 2022/23 to 2024/25, and Home Upgrade Grant, investing a further £950 million over 2022/23 to 2024/25, which aim to improve the energy performance of low income households’ homes, support low-carbon heat installations, help to reduce fuel poverty and build the green retrofitting sector to benefit all homeowners. This could also be dealt with in HMT’s Net Zero Review. |

Yes |

|

8 |

Making low-carbon buildings financially attractive |

Increased funding for low-carbon heat. CCC suggests that by-and-large, existing schemes are well-targeted. Major funding gaps are: 3. With the scrapping of the Green Homes Grant, there is a funding gap for the able-to-pay market, as remaining energy efficiency schemes focus on the public sector or social housing. |

The CCC note that the Government’s proposals in the HBS move more quickly away from public funding to a market mechanism and note that if this is successful, this would be a desirable outcome, but it brings different delivery risks, which will need to be carefully managed. The CCC warn that if costs do not fall as rapidly as the Government expects, or the market mechanisms stall, increased public funding may prove necessary. They also state that public funding is uncertain beyond the Spending Review (2024). |

No |

|

9 |

Enabling measures - information and skills |

The Government should move beyond a reliance on EPCs (which have limitations around quality control and limited scope). This should involve an urgent plan to improve EPCs, and use other informational approaches - PAS2035 home retrofit plans, and digital green building passports |

There is no mention in the HBS on how to reform EPC and adopting a more holistic approach including digital green building passport to unlock green finance |

No |

|

10 |

Enabling measures - information and skills |

A policy framework is needed to develop the skills necessary for a green buildings sector. Current institutions are not equipping the buildings sector with the necessary skills |

There is no clear policy framework in how the green buildings sector will develop the skills necessary to reduce the sector's emissions. The HBS states that the Green Jobs Taskforce's action plan for England will be published in Spring 2022. |

No |

|

11 |

Enabling measures - information and skills |

Skills policy framework should also scale up inspections and enforcement activity, to ensure that legislated standards are actually being applied |

There is no mention of scaling up inspections and enforcement activity in upskilling employees to ensure legislated standards are being applied |

No |

|

12 |

Getting on with it |

Undertake Local Area Energy Plans for Local Authorities to better understand the specifics of low-carbon heat delivery in each local area |

The CCC notes that the Heat and Buildings Strategy is vague on the role for local area energy planning. The HBS states that BEIS has work underway with Ofgem to develop a better understanding of the opportunities and challenges presented by local area energy mapping and planning and is considering the most appropriate policy options to take forwards. |

Partly |

|

13 |

Getting on with it |

BEIS and Ofgem should collaborate on a major study to identify prime candidate areas for hydrogen/full electrification at a national level. |

The HBS proposes ongoing collaboration between BEIS, Ofgem and Distribution Network Operators (DNOs) to collect and share data on the impact of heating assets on the electricity networks. However specific plans for strategic investment in electricity networks are not expected until later this year. |

No |

|

14 |

Getting on with it |

Supporting Pathfinder Cities/Areas, which can provide a large-scale context in which to trial low-carbon heat, engage the public and generate information about system issues. BEIS/MHCLG could identify 3 demonstrate areas for 2025-30, plus a pipeline for the 2030s. |

- The Government state they will continue to invest in 100% hydrogen heating trials through a neighbourhood trial by 2023, a village trial by 2025, and a possible hydrogen town pilot by 2030, which will allow them to take strategic decisions on the role of hydrogen in heating by 2026. - There is no mention of a Heat Delivery Body or similar body to formalise governance structures and coordinate national, regional and local government. - The Government is working on and investing £338 million over 2022/23 to 2024/25 into a broader Heat Network Transformation Programme to scale up low-carbon heat network deployment and to enable local areas to deploy heat network zoning, which will create a step change in low-carbon heat network market growth. |

Partly |

| 15 | Provide clear direction | Provide a stable long-term policy framework to support sustained energy efficiency and heat pump growth at sufficient scale (i.e. 600,000 heat pumps per year in existing homes by 2028). This must include a replacement for the Green Homes Grant voucher scheme which works, backed by standards and support for non-residential heat pump installations. Create a level-playing field for hybrid heat pumps off the gas grid and ensure hybrid heat pumps are an integral part of PAS2035 retrofit coordinator advice. | The Government state they will go from installing around 35,000 hydronic heat pumps a year to a minimum market capacity of 600,000 per year by 2028, however the CCC recommend 900,000 a year. by this date. This will be supported by the introduction of a market based mechanisms to establish the incentives for industry to take the lead in transforming the consumer market in low-carbon heating, which is subject to consultation. As such, this does not rely on a long-term policy framework. However, the HBS did announce the Boiler Upgrade Scheme, to support deployment of low carbon heat in existing buildings. This will provide households with £5,000 grants when they switch to an air source heat pump or £6,000 when they switch to a ground source one. | Partly |

| 16 | Making low-carbon buildings financially attractive | Fund plans towards making all public buildings a zero-carbon in the long term. This must include a move to multi-year programmatic funding to deliver the stated ambitions of halving emissions from public buildings by 2032, supported by cross-government strategy (including an updated set of Greening the Government commitments) and capital funding levels in the order of £1 billion/year for buildings. | The CCC states that for public sector buildings, the delivery policy in the HBS focuses on providing funding and capacity to public sector organisations and asking them to disclose progress annually against their emissions reduction plans. They state it is unclear how effective these plans will be. There is no suggestion of an EPC or in-use performance-based target for public sector buildings. The Government will invest £1425m in the Public Sector Decarbonisation Scheme over 2022/23 to 2024/25. However, the CCC note there is still a public sector funding gap of between £ 0.9-1.2 billion. There is also no multi-year settlement. The HBS states that the Government aim to reduce direct emissions from public sector buildings by 75% against a 2017 baseline by the end of Carbon Budget 6 in 2037. | Partly |

| 17 | Provide clear direction | Ensure that the remit of the new buildings safety regulator covers climate change mitigation and adaptation, and is equipped to monitor and enforce compliance with buildings standards. Work with HM Treasury to ensure that local authorities are properly funded to enforce buildings standards. | The Building Safety Bill is currently making its way through Parliament | N/A |

| 18 | Provide clear direction | Close loopholes allowing homes to be built which do not meet the current minimum standards for new dwellings. Make accurate performance testing and reporting widespread, committing developers to the standards they advertise | The Government has said it will increase standards for new-builds in the 2020s to ensure that they are ready for Net Zero. | Yes |

| 19 | Getting on with it | Develop plans to rapidly scale up the levels of wood used in construction and support the assessment and benchmarking of whole-life carbon in buildings | The Government state they are working with industry to develop and test Whole Life Carbon methodologies for major built assets | Partly |

| 20 | Getting on with it | Work with BEIS on the Buildings and Heat Strategy, and a strategy for net-zero manufacturing to ensure that relative prices favour a shift to low-carbon technologies that sufficient funding is available and to consider the role of tax incentives (e.g. Stamp Duty differentials). Work with MHCLG and the new buildings safety regulator to ensure that local authorities are properly funded to enforce buildings standards. | The Strategy commits to the launch of a Fairness and Affordability Call for Evidence to help rebalance electricity and gas prices and to support green choices, with a view to taking decisions in 2022. The CCC has said this must progress in the coming months. There are no tax incentives however in the HBS to encourage a shift to low-carbon technologies. | Partly |

Last updated March 2022