Manufacturing and Construction

CONTENTS

Progress Ranking and Key Recommendations | Sector Summary | Recent Policy Developments | Further detail: CCC policy recommendations

Progress ranking and key recommendations

|

Progress Ranking: Insufficient/On the Way (4/10) |

Key actions on the road to world-leading policy: |

|---|---|

|

|

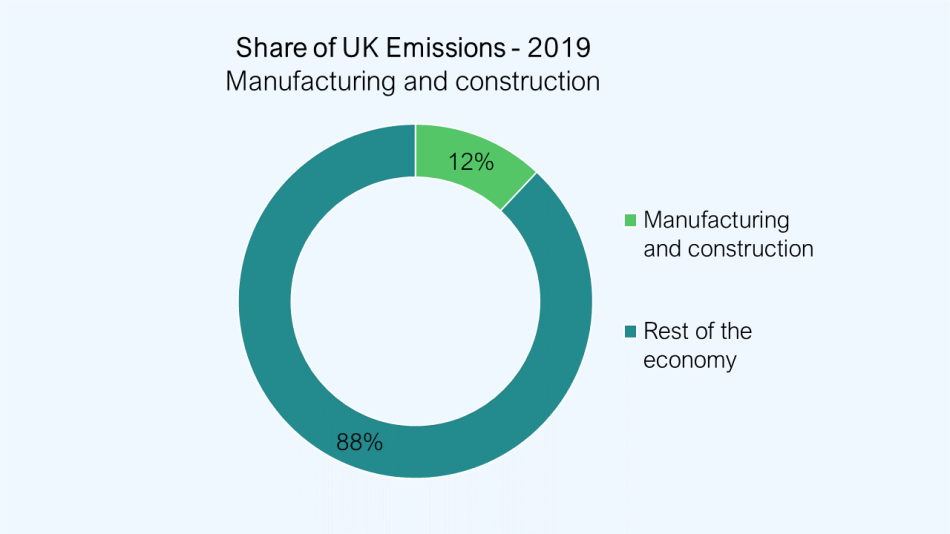

Sector Summary

|

Source: Climate Change Committee - Sixth Carbon Budget (2020) |

Recent Policy Developments

- Prior to 2021, the Government had announced funding for industrial decarbonisation including the Industrial Energy Transformation fund (£315m), Clean Steel Fund (£250m), Industrial Decarbonisation Challenge Fund (£170m), Transforming Foundation Industries (£66m), Industrial Fuel Switching Fund (£20m) and Green Distilleries Fund (£10m). These schemes provide money for capital costs, and do not address the potentially higher operating costs of low-carbon manufacturing.

- The UK’s Energy White Paper committed £1bn in funding for CCUS up to 2025, £240m for the Net Zero Hydrogen Fund out to 2025, and confirmed the UK will introduce its own Emissions Trading Scheme to replace the EU ETS. The UK's ETS will initially have a cap 5% lower than the EU ETS, and the Government has committed to aligning the ETS with the UK's Net-Zero target by 2024.

- The Industrial Decarbonisation Strategy was released in March 2021. This set an expectation that emissions should fall 66% by 2035 and 90+% by 2050, with 3MtCO2 of industrial carbon capture and storage and 20TWh of fuel-switching by 2030. It also increases the Government's commitment to Industrial Clusters, with an aim of delivering four low-carbon clusters by 2030 and at least one net-zero cluster by 2040.

Further detail: Policy recommendations from the CCC and underlying progress made

|

# |

Focus |

Key Recommendation from the CCC |

Government Progress |

Met? |

|---|---|---|---|---|

|

1 |

Overarching Strategy - Industrial Decarbonisation Strategy |

We need to move from the current piecemeal approach. The Industrial Decarbonisation Strategy needs to be comprehensive (e.g. not exclude historically neglected areas such as off-road mobile machinery), have clear long-term vision, and integrate with other strategies around Hydrogen, Infrastructure, Heat and Buildings and Energy. |

The Net Zero strategy sets out ambition to reduce industrial emissions by 63-76% by 2035 from 2019 levels. This represents a substantial step forward in Government’s ambition, and is broadly aligned to the CCC Balanced Pathway, in which the equivalent emissions are reduced by 71% by 2035. Strategy does have long-term vision and references other strategies – but does not detail how/whether off-road mobile machinery will be dealt with. The Hydrogen Strategy references the launch of a new £40 million Red Diesel Replacement Competition to fund the development and demonstration of innovative technologies that enable Non-Road Mobile Machinery (NRMM) used for quarrying, mining, and construction to switch from red diesel to hydrogen or other low carbon fuels. |

Partly |

|

2 |

Policies to support jobs and the recovery |

The Government should ensure prompt award of existing industrial funding schemes to create jobs in regions with large industrial bases, and increase the ambition of these schemes. |

No increase in funding for these schemes, just allocation of existing funds. |

No |

|

3 |

Competitiveness concerns. To address these, the Government will need to think about taxpayer funding, carbon pricing with border carbon tariffs, or minimum standards to protect domestic industries. Industrial decarbonisation should likely start with taxpayer funding, and then transition towards some form of border carbon tarriff/minimum standards to protect a UK market. |

Developing carbon intensity/measurement standards |

They will ‘consider the benefits of a voluntary product standards system following the results of the call for evidence, with a view to their potential introduction by 2025. This is a good start – but should be stronger than simply ‘considering’ and ‘potential introduction’. |

Partly |

|

4 |

Competitiveness concerns. |

Mandating disclosure of carbon intensity for selected products |

Mandatory disclosure of carbon intensity is mentioned but left as a possibility, with no firm commitment made. |

No |

|

5 |

Competitiveness concerns. |

Fostering international consensus around future trade policy for traded industrial goods. |

There are many references to the importance of international consensus and the UK’s desire to work on this. |

Yes |

|

6 |

Carbon and electricity pricing for decarbonisation |

Introduce a decarbonisation price signal in the non-traded sector. Currently the only price signal here is the climate change levy (CCL), and the CCL price is higher on electricity than gas, which will not drive decarbonisation. Although this will equalise by 2025, more needs to be done. The future carbon price should apply to whole sector, and CCL should be reformed to actually focus on carbon content. |

UK ETS doesn’t cover whole sector, and no mention of reforming the CCL |

No |

|

7 |

Carbon and electricity pricing for decarbonisation |

Stronger carbon pricing. Prices should be higher than current EU ETS prices |

The NZS states carbon pricing through emissions trading underpins the UK approach to decarbonising industry, and is now supplemented by grant funding and contracts for capturing carbon from, and supplying hydrogen to, industrial clusters. Commits cap on UK ETS to be net-zero aligned by 2024, and the initial cap to be 5% below the EU ETS equivalent cap. |

Partly |

|

8 |

Carbon and electricity pricing for decarbonisation |

Ensure cost-reflective electricity prices. Current electricity prices include legacy costs from network development, and the price support for renewables that was needed in the 2000s and 2010s. They therefore do not reflect the actual cost of introducing new renewable generation to meet demand. |

Plans to support electrification and resource efficiency, and for manufacturers not covered by emissions trading, are less advanced. This however, is not equivalent to committing to future cost-reflective prices. |

No |

|

9 |

Addressing manufacturer's appetite for risk |

Capital grants could be provided e.g. via the Industrial Energy Transformation Fund or other existing capital allocation schemes. |

- Industrial Energy Transformation Fund – Phase 2: will provide additional support for businesses to fuel switch to hydrogen or electrify their industrial processes through grants that support the upfront costs of installing or retrofitting onsite industrial equipment. - The Fuel Switching innovation competition and Hydrogen Supply competition will help to proactively accelerate the development of potential electrification or hydrogen technologies. |

Yes |

|

10 |

Addressing manufacturer's appetite for risk |

Introduce tailored loans that reduce risk and allow long-term investments (e.g. below-market-rate loans, or funding from National Infrastructure Bank) |

While there is no mention of tailored loans, there is a strong emphasis on sharing risk between the Government, producers and consumers. |

Partly |

|

11 |

Funding mechanisms for deep decarbonisation - Should establish a funding mechanism to enable early deployment of low-carbon solutions. Currently there is not a business model for these, and policies have focused on capital costs rather than operational costs. |

Establish funding mechanism(s) to support both electrification and hydrogen-use in manufacturing, as soon as possible, with the aim of awarding funding in 2022. There must be mechanisms for both options, not only hydrogen, and the mechanism(s) should be designed to ensure that, in the medium term, hydrogen-use and electrification compete on a level playing field, to ensure the best value for consumers and taxpayers. Support for electrification may be combined with reforms to electricity pricing. |

The Hydrogen Strategy states the Government intend to provide a response to the consultation on a Hydrogen Business Model in Q1 2022. The Government aims to finalise the business model in 2022, enabling the first contracts to be allocated from Q1 2023. They will provide further detail on the revenue mechanism which will provide funding for the Business Model in 2022. There has been no mention of a business model for electricity, however. |

Partly |

|

12 |

Funding mechanisms for deep decarbonisation. |

Deliver industrial carbon capture contracts for CCS to enable final investment decisions on the first CCS projects by mid-2022. |

They plan to ‘finalise the industrial carbon capture business model in 2021 and to implement it in 2022.’ This will cover both costs for capturing CO2 and also the transport and storage of CO2. |

Yes |

| 13 | Funding mechanisms for deep decarbonisation. | Deliver the proposed CCS transport and storage regulatory investment model to enable final investment decisions by mid-2022 that are consistent with establishing at least two CCS transport and storage clusters in the mid-2020s. | They plan to ‘finalise the industrial carbon capture business model in 2021 and to implement it in 2022.’ This will cover both costs for capturing CO2 and also the transport and storage of CO2. | Yes |

|

14 |

Support for Innovation and Demonstration |

Continue to support innovation and demonstration of fuel switching and CCS technologies for decarbonising manufacturing and construction. Ensure that a full range of options is developed, filling previous gaps in support, such as encouraging electrification projects to come forward. |

The Industrial Decarbonisation Strategy provides a whole section on accelerating innovation of low-carbon technologies, but there is no new money announced for existing funds which can drive innovation and demonstration (e.g. Clean Steel Fund), or any acceleration of spending commitments, and in particular no detailed plan for supporting key technologies such as hydrogen-based steelmaking.

In February 2021, a new research agency focused on high risk, high reward science was launched, the Advanced Research and Invention Agency (ARIA). However, it is not clear how this body will lead to innovation and successful commercialisation of low-carbon industrial technologies at the pace needed. |

Partly |

|

15 |

Policies focused on resource efficiency, energy efficiency and material substitution |

Consumer products: the Government should take Eco-design regulation from the EU, and enforce continual improvements in product standards, and expanded coverage to cover all major goods. The Government should consider expanding plastics tax to all single-use materials. The Government should work with businesses to develop more sustainable consumer behaviour – e.g. car clubs and libraries of things. |

The Government will ‘consider’ expanding existing labelling for consumer products to cover embodied emissions by mid-2020s. The Industrial Decarbonisation Strategy commits to driving a transition towards a circular economy model with greater reuse, repair and remanufacturing (Action 5.5), but no particular details of how this will occur. No mention of expanding the plastics tax. |

Partly |

|

16 |

Policies focused on resource efficiency, energy efficiency and material substitution |

The Government should work with industry to set a standard for the ‘whole-life’ carbon footprint of buildings, introduce mandatory disclosure of whole-life carbon in buildings/infrastructure by 2025 (to enable benchmarking), and then introduce a continually strengthening limit on whole-life carbon standards, differentiated targets by function, scale, and public/private construction. |

The Government state they are working with industry to develop and test Whole Life Carbon methodologies for major built assets but nothing has been formally committed. |

No |

| 17 | Policies focused on resource efficiency, energy efficiency and material substitution |

Develop policies to drive more resource-efficient construction and use of existing low-carbon materials, including a substantial increase in the use of wood in construction. Policies should include: • Reviewing and clarifying the position of structural timber in the ban on combustible materials, underpinned by further research and testing where necessary, and ensuring there are no barriers to the safe use of timber in buildings. The buildings safety regulator to play a role in overseeing this on an ongoing basis. • The development of a fully-funded policy roadmap on the use of timber, including policies to support the development of UK wood supply chains. |

In the Net Zero Strategy, the Government stated they will work with key stakeholders to develop a policy roadmap to increase the use of timber in construction in England, and will create a cross-government and industry working group tasked with identifying key actions to safely increase timber use and reduce embodied carbon | Partly |

| 18 | Policies focused on resource efficiency, energy efficiency and material substitution |

Step up efforts to deliver the waste prevention and resource efficiency improvements required as part of the pathway to Net Zero, including by:

|

The CCC state that more detail is required to assess upcoming policies to encourage resource efficiency, and these will need to be broadened and strengthened. On construction, the Government say they are supporting the launch of the Green Construction Board’s routemap towards Zero Avoidable Waste. The new Waste Prevention Programme is yet to be published | No |

|

19 |

Policies focused on resource efficiency, energy efficiency and material substitution |

Manufacturer’s energy efficiency. Government should consistent strengthening enabling policies, such as Climate Change Agreements, or mandating use of Energy Management Systems, which can help businesses improve their energy performance, in order to achieve the additional 12TWh of industrial energy efficiency potential identified by the Government. |

The Government note that the Climate Change Agreements (CCA) scheme was extended in 2021 by two years through the addition of a new target period (1 January 2021 to 31 December 2022) and reduced rates of Climate Change Levy in place until March 2025. There is a commitment to 'supporting' sites to use Energy Management Systems, and an acknowledgement that uptake so far has been limited. There is no mention of mandating EMSs. |

Partly |

|

20 |

Off-Road Mobile Machinery |

If Off-Road Mobile Machinery is not covered here, or in Heat and Buildings/Transport Strategies, it should be covered in the Net-Zero strategy. |

There is no mention of where this sector will be covered. |

No |

|

21 |

Infrastructure Development |

CCUS: Develop plans for 2 clusters by 2025, and at least 4 by late 2020s, with more around 2030. Also work with mineral industries to detail a plan for CO2 transport from dispersed sites. |

The Industrial Decarbonisation Strategy commits to achieving 2 clusters by 2025, and 4 clusters by 2030. Arguably the CCC recommendation is to exceed this ('four by the late 2020s, with more around 2030). There is commitment to plan with mineral industries around CO2 transport from dispersed sites. |

Partly |

|

22 |

Infrastructure Development |

Hydrogen: Early hydrogen distribution will be via dedicated pipelines, in advance of any gas network conversion. Therefore the Government needs to decide how to do this, and consider which areas should have gas network conversion first. |

There is no mention in the Hydrogen Strategy of how the Government will approach the geographical challenge of H2 rollout and determine which areas should be converted first. There is also no mention in the Hydrogen Strategy on decisions about whether initial areas of the gas transmission and distribution networks should be converted to hydrogen, this may come in the heat and buildings strategy. The Hydrogen Strategy states that by 2025-2027 there will be dedicated networks in place/repurposed, expanded trucking and the necessary centralised storage in place for hydrogen, with large dedicated networks and storage in place (new or repurposed) by 2028-2030. From the mid-2030s onwards, the Hydrogen Strategy states that regional and potentially national distribution networks will be in place. |

No |

|

23 |

Target Dates |

Gov should be targeting near-zero primary steel from 2035, and near-zero cement from 2040. |

The Net Zero Strategy says it will consider the implications of the recommendation of the Climate Change Committee to set targets for ore-based steelmaking to reach near-zero emissions by 2035. The IDS Strategy mentions near-zero steel from 2035, but neglects to mention cement. The discussion of near-zero steel is not a clear commitment, but simply a decision to 'consider the implications' with industry. |

No |

|

24 |

Skills |

Should engage with the Engineering Construction Industry Training Board, and new Green Jobs Taskforce to think about skills gap for industrial decarbonisation. |

There is a commitment to map the skills requirement for a net-zero industrial sector during 2021 |

Yes |

Last updated March 2022